This week’s announcement during ONS of a new joint venture between Schlumberger, Aker Solutions and Subsea 7 is a bit more than it appears. Firstly, it replaces the existing Subsea Integration Alliance venture between Schlumberger and S7 and secondly, it contracts the market for subsea hardware supplies, so that some sectors will no longer have bidding from the big four suppliers plus, in some places, DrilQuip.

Schlumberger and AkerSol are being a bit cagey about this deal. The former would only say that this is a deal which is complementary geographically, while AkerSol’s people have not even been able to say what parts of the subsea supply market are included. From the geographic point of view, this means that OneSubsea, Schlumberger’s subsea equipment division, formerly known as Cameron, will no longer spend time and money trying to win business in the important Norwegian market where it has not sold any production hardware for decades. Similarly AkerSol will likely not lose any sleep over a possible withdrawal of hardware marketing – but not umbilicals – from the Gulf of Mexico where it has struggled to win much business over an extended period.

There are major overlaps in what the two companies can supply which is probably why this is not being called a merger, despite what some publications have said, of the two subsea hardware suppliers as that might attract even more unwanted attention from competition regulators. While Schlumberger will own 70% of this JV, AkerSol 20% with S7 the balance, AkerSol is getting $306.5mn in new Schlumberger shares plus the similar amount from S7 for its 10% with the JV giving AkerSol another $87.5mn in a promissory note.

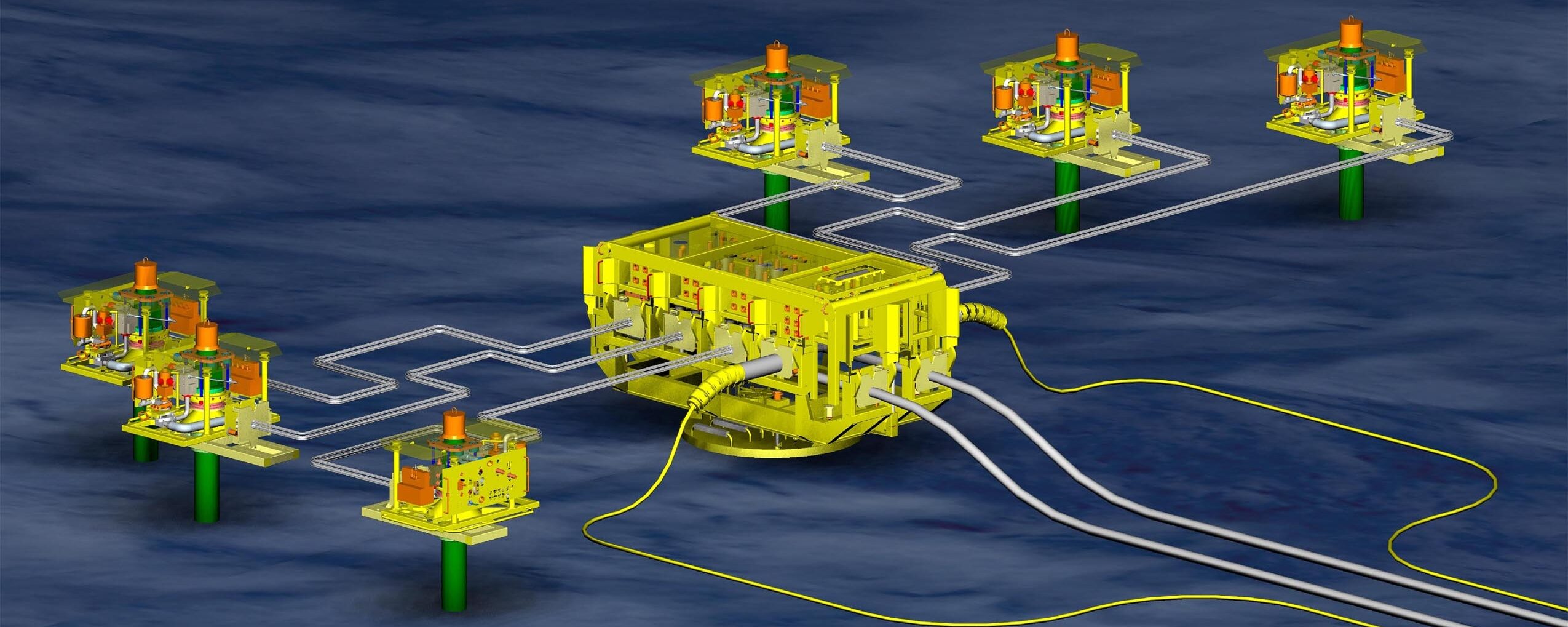

The area that seems most problematic is subsea processing. These two have competed aggressively in the active Norwegian market and elsewhere with Schlumberger’s activity based on some technology first developed by the once and former Framo Engineering, while AkerSol has mixed and matched various parts of its inhouse equipment in the subsea separation, gas compression and pumping systems markets.

The other part of the market which will be affected is for umbilicals. Now any EPC bidding which includes umbilicals will reduce the opportunities for other players in the market such as Nexans and JDR, although the latter has taken a big place in the offshore wind farm market.

Probably unbothered by this deal is market leader TechnipFMC. It has such a strong position (40% market share?), created over a long period based on frame agreements with some of the biggest operators, that it will simply be business as usual. As is often the case, we await further developments, but one wonders how the new Chinese subsea xmas tree supplier will view this new opportunity?

**********

Of all the big offshore shows, I miss going to ONS the most. Norway was and remains one of the centers of the subsea universe and always provided lots of interesting news and activity for me in my former guise as editor of Subsea Engineering News. Folks always wanted to talk to me and there were lots of readers there. What I won’t miss is the eyewatering cost of eating and drinking there, although this summer I may have a more expensive beer elsewhere. The last time I attended UTC in Bergen, a well-to-do (!) colleague bought me a beer and the two cost roughly £25. This summer I went to a baseball game in the US and a large can of beer cost $14. Don’t take me out to the ballgame!

**********

I will throw my cards on the table as I have always done: it is now more than a year since the estimable Bil Loth passed away and we are still waiting for the slumbering SUT to do something to honour this great figure in the subsea world. How about it?