I am excited. OK, I am enthused, just so no one calls out the fire brigade. In the last fortnight, the subsea project market seems to have come alive. Of course, all of the work that was announced was bid three to six months ago, so in essence they are not new. But when activity comes to the fore seemingly all at once, it just gets the blood coursing around one’s veins.

Now I need to put my cards on the table. I am an environmental realist. Anyone who thinks that the change in the world climate or the increase in extreme weather events is simply coincidental or has nothing to do with human activity needs a quick brain scan. And those pushing ever more unchecked oil and gas activity are disingenuous, greedy and don’t care about the future of this unique planet. (NB: It is possible to criticise moderately without climbing on a soapbox.) We do need to change direction to reduce emissions and the use of hydrocarbons so we can ensure a world for our grandchildren – and I have five already – that does not look like a dystopian nightmare. Likewise unless everyone throws away their laptops, tablets, smartphones, 72in televisions, Kindles, microwaves, popcorn poppers, et al, and even non-hydrocarbon powered vehicles, we need to keep producing electricity some way until wind, solar and other renewable forms of power generation can fully take over, ie we need hydrocarbons for several decades yet. Even the IEA report this week which states emphatically that offshore wind can provide all of the electricity that the world needs did not say when. So I can get excited about some new subsea projects without feeling the need to go to a confessional, that is if I were Catholic.

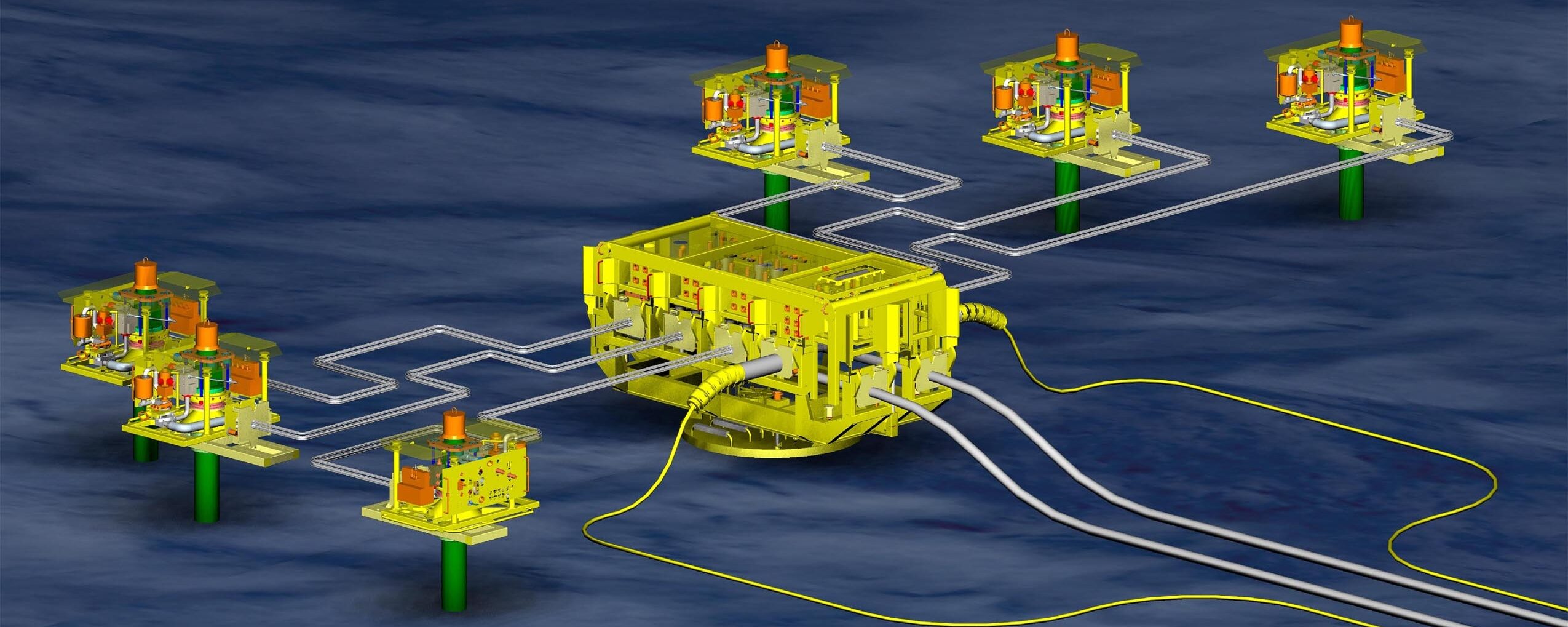

Back to the subject at hand, that is subsea. What is noteworthy now – and has always been a source of fascination – is that subsea continues to offer both the type of new technology and low-tech solutions that its proponents have been proffering for more than three and a half decades. So while the industry has spent the last five years focusing mostly on cost cutting and new economic models, the engineers have continued to keep their thinking caps on as well.

So what’s to report? On the other side of the pond, US indy LLOG is pushing ahead with the Shenandoah development and has ordered the first 20K subsea xmas trees – from TechnipFMC – for this deepwater (1,700m) field with reserves in the range of 100-400mmbbls.

There are so many interesting facts about this development it is hard to know exactly where to begin. Firstly, the licence group is indicative of the changing face of the GoM. This discovery was made in 2011 by Anadarko as part of a group of well-known companies including ConocoPhillips, Marathon and Cobalt Energy. None of these companies is involved anymore. The group now includes Beacon Offshore, Navitas Petroleum and Venari Offshore. Never heard of any of these companies? So what.

What is more noteworthy is that two years before the Shenandoah find was even made, Anadarko was thinking ahead and already supporting the development of 20K hardware. I could not find a reference, but assume it was supporting FMC considering Anadarko’s long association with that hardware manufacturer. This was also a year before the Deepwater Horizon disaster which resulted in the accelerated development of 20K bops in the aftermath of that well debacle.

For those who have been around the subsea scene fore a while, it seems that the advent of 15K equipment was only yesterday, but it was in 1999 that Cameron supplied a 15K subsea xmas tree for the Gyrfalcon field in GoM waters.

The other awards in the last week or so have been for Perdido 2 in the GoM and Pyxis/Xena offshore Australia. The former is of note as it features TechnipFMC’s new compact inline manifold which is a deviation from the first stage of Perdido which featured wells directly below the spar. Down Under, Woodside has activated its new five year EPCI frame agreement with TFMC – sorry to keep mentioning this company – with awards for two new deepwater (985m and 862m) wells on the Pyxis field and several additonal wells at Xena. Both fields will feed gas to the Pluto platform which pipes it onward to the onshore LNG facility.

Closer to home, Parkmead is pushing ahead with the Platypus development in the UK’s gas-prone Southern Basin. Parkmead is one of those companies which makes you feel like a dentist – getting any info out of them is like pulling teeth. Headman Tom Cross has called this development ‘an innovative subsea tieback’ without explaining the use of that adjective. What it has been possible to glean is that this 100bcf plus find will be a 23km tieback to the Cleeton complex which is not excessively long, but could present some challenges depending on the water content and temperature. What I do think is that this originally may have been an unmanned platform scheme which has become subsea and if that is the case, someone has come up with a significant cost reduction scenario.

Parkmead is getting increasingly interested in subsea. It has altered the initial plan for the Greater Perth Area (which includes Dolphin) from an fpso to a subsea tieback to Scott, a plan which is now being studied.

Addendum: I finally got both TFMC and Parkmead to answer my questions – my arm hurts for pulling so hard. I have to give myself a tick on Parkmead for being spot on – the Platypus concept was originally an NUI (normally unmanned installation) with three wells, but is now two subsea wells, dubbed sub-horizontal. So it was all about cost. As for the 20K activity, TFMC began this back in 2014 under a Joint Development Agreement with five operators and finished qualification work this year. That leaves the issue of who was doing what back in 2009, but my money remains on FMC as Anadarko has only bought FMC hardware since it first ventured into the GoM’s deeper waters.