The lead up to Subsea Expo, this coming week in Aberdeen, always seem like an appropriate time to say something formative about our favourite technology. While much of the conversation these days is about the energy transition away from hydrocarbons, there is little doubt that the world will still be depending on fossil fuels in one form or another for many years to come.

This is unlikely to be what those preaching about climate change want to hear, but it is pretty clear that unless people are ready to give up their centrally heated homes, their mobile phones, their laptops, their game consoles and their electric cars and not go on planes for the forseeable future, we will need traditional energy sources for quite awhile. Assuredly some folk would have been shocked to know that the key backup if gas-fired power generation could not meet the national needs was going to be from coal-fired power stations. Yikes.

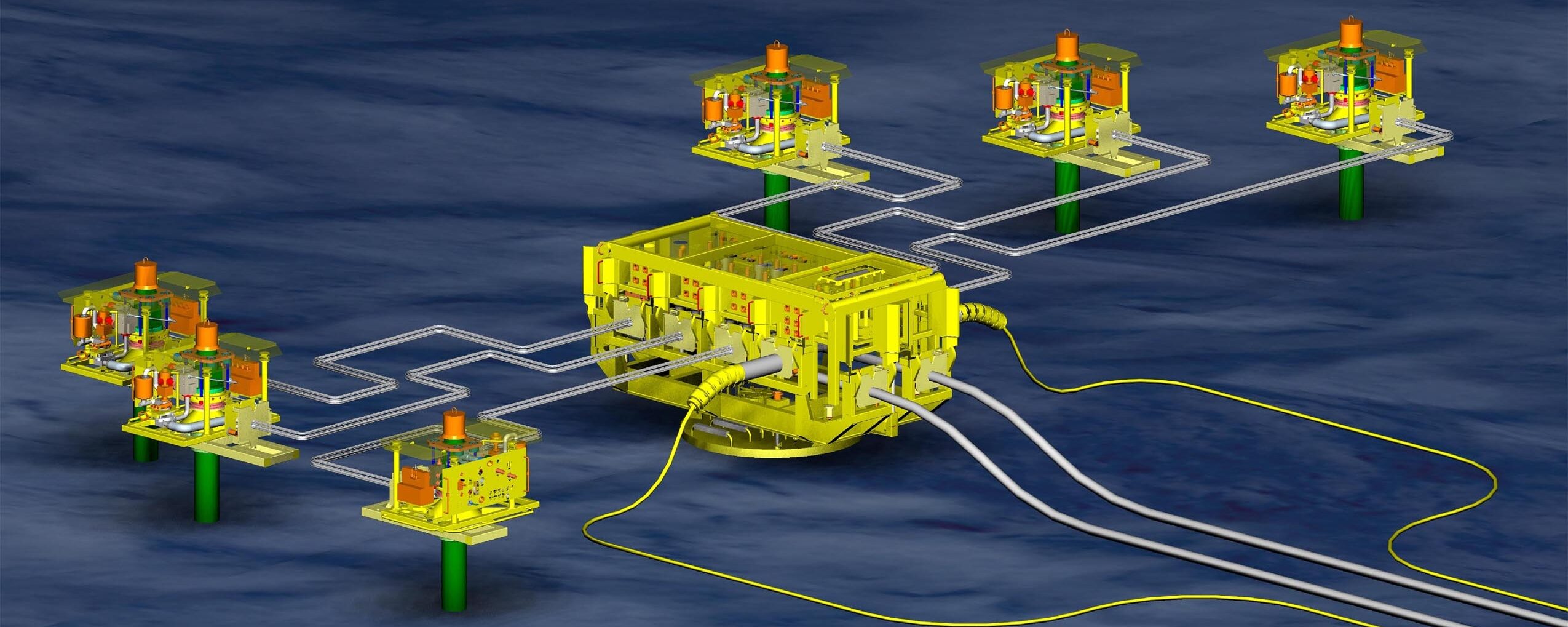

While I am not totally keyed into the subsea world as I was when that was much of what I thought about, there are things going on and new companies, sort of, who might be worth mentioning as they seemed new to me. It is worth noting that subsea production continues to have an allure beyond technical issues. Put something on the seabed, no one sees it and there are no direct emissions until you get to the platform. Make it all electric and that is even better. It is easy to see the attraction.

One technology that is about to hit the development phase is Hi-Sep, a Petrobras-patented separation technology that is aimed at high GOR (gas-oil ratio) and high CO2 content reservoirs. An award to deploy the technology at the Mero-3 pre-salt field, offshore Brazil, was due last year, but the tender was delayed, as often happens down there. Three bidders – Aker Solutions with Saipem, the OneSubsea/Subsea 7 Subsea Integration Alliance and TechnipFMC – are vying for this job. Whether Hi-Sep will be used very often depends on the reservoirs. Operators are not often keen to develop fields with those specifications, particularly high CO2 .

The other big advance, although hardly new, is on 20Kpsi technology. BP began looking at this more than a decade ago in the post-Macondo era. The technology crosses the whole subsea system, but the 20K BOP was always seen as key as it will provide the safety factor in any development. NOV is certainly pushing its hardware. The Shenandoah field in the Gulf of Mexico is getting 20K trees from TechnipFMC.

There are a few companies that have pushed their names forward in recent times. Optime is one with its ROCS modular well access system, Trendsetter Engineering is also providing 20K equipment, in the form of a subsea well intervention package for Shenandoah, as is Koil Engineering with is Multi Quick Connect plates. If the latter is a mysterious name, it was formerly known as Deep Down.

As always seems the case when subsea is involved, there is a good deal of activity in Norway, much of it with satellite fields taking advantage of the vast array of existing facilities. The one development that caught my eye is Equinor’s Irpa field in 1,350m. It is an 80km gas tieback to the Aasta Hansteen spar in similar water depth. It is a pipe-in-pipe system with insulation and MEG injection, all designed to mitigate the effects of the extreme temperature. Subsea7 will handle this complex installation.

Of course there is a plethora of activity all over the world – from Guyana to Angola to Australia and South Africa – some sectors long established and others less so. The contracting and supply sectors are in full flow.

There are some concerns, though, for the long term. I have begun researching UK engineering education and at least at one of the major universities, the number of students focussed on offshore oil and gas engineering is way down and is being kept going by overseas students. What this means for who will be engineering the future fields is anyone’s guess. When all the data is in, I will report back. Hope to see you at Subsea Expo – I can be contacted in the usual ways.