I don’t always believe everything that appears in oilfield rags, but Upstream is one of the mostly reliable ones. So the item that appeared last week about Chevron planning to sell off its remaining UK North Sea assets and exit the sector, made some sense, but also made me go all nostalgic for the happier and more interesting times in the offshore world.

Unlike some of the major companies, Chevron was one of the operators which was easy to deal with and returned the respect it earned by respecting the journalists who covered the sector. It was also one of the early movers and shakers in the UK North Sea, having begun installing the three-platform Ninian complex in the late 1970’s. Later it was also one of the companies who saw the potential in older facilities as processing hubs for newer smaller subsea fields. Thus was born the Ninian Third Party Project (NTPP) in the early 1990’s.

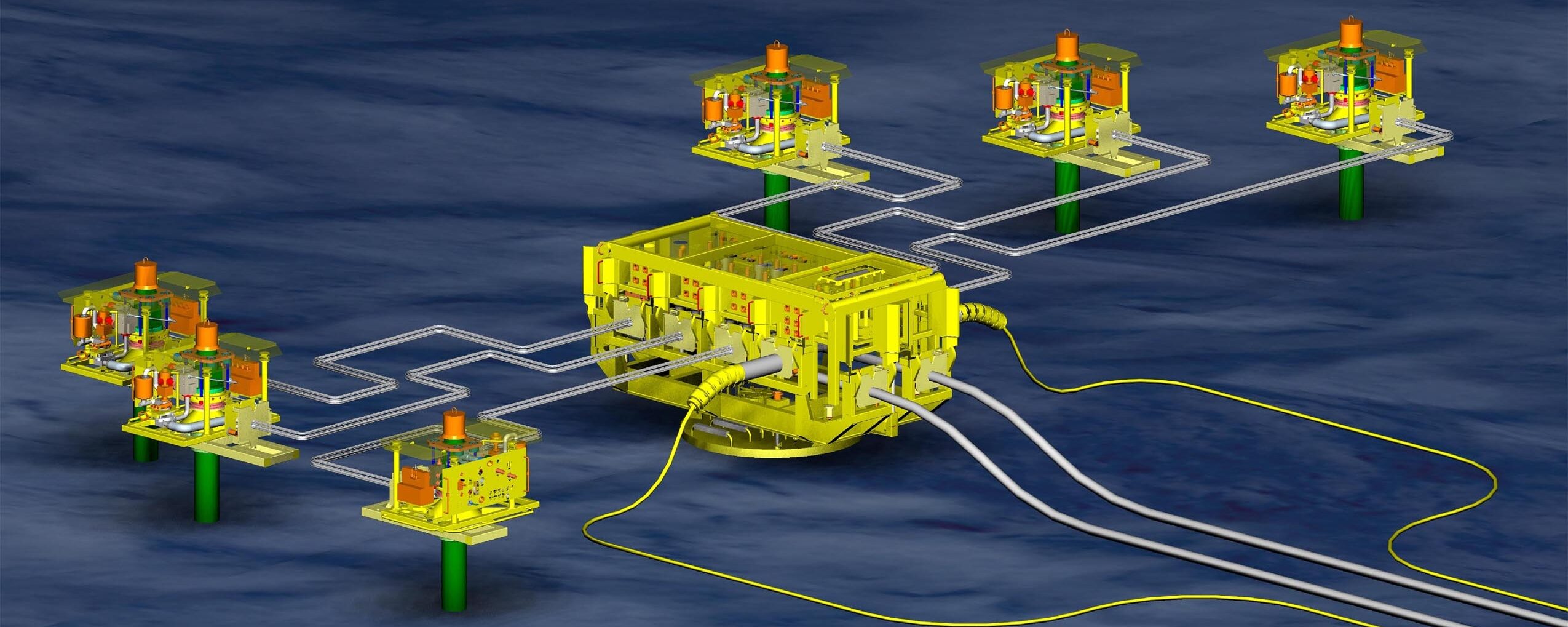

The concept was ace. There were a number of small nearby fields, owned by other operators (Conoco Lyell, Texaco Strathspey and Lasmo Staffa), in need processing and other support facilities. Chevron launched NTTP which involved altering and upgrading at least two (or was it all three) of the Ninian field platforms. While the concept was good, the initial operational aspect was less so. Chevron looked at NTTP as a glorified maintenance project rather than the complex integration scheme it really was. Within a short period of time, the company discovered it was already 100% over budget and six months late. The result was a quick switch to full project status with its own project director. It was a harsh lesson for Chevron, but it and others learned that they should not underestimate the complexity of subsea tiebacks.

Chevron took on board other lessons from the North Sea and used them well on the deepwater Gorgon subsea gas development, offshore Western Australia. Other experiences were less well learned. In the post-Macondo-Deepwater Horizon era, the then head of drilling for the company took a poke at BP in a public forum for its oversight failures at one of the industry’s worst environmental events. Alas, not long afterwards Chevron had its own drilling failure with a jackup in Nigeria and other problems in Brazil. One of the harshest lessons is not to criticise others for their mistakes, , because there but for the grace of god go thy!

******************************

The recent announcement of the collaboration between Equinor and OneSubsea (which now incorporates activities with Subsea7 and Aker Solutions) on the upcoming Wisting (Norway) and Bay du Nord (Canada) projects made me wonder when the last time Equinor-cum-Statoil worked so closely with the company formerly known as (cfka) Cameron.

As I recall, it has been decades since the Norwegian state company bought any subsea hardware from Cameron, although, of course, there has been subsea processing kit from the cfka Framo Engineering, which was partially owned by Statoil, before Schlumberger bought the remaining shares it did not already own and then incorporated its activities in OneSubsea. As those in the subsea world are aware, TechnipFMC has dominated the subsea hardware supply market to Equinor through various frame agreements over the last several decades, although Aker Solutions has had some contracts, primarily for its vertical tree systems in recent times.

As I no longer speak to people in the market as closely as I once did, it has never been clear to me that within the ‘new’ OneSubsea who is supplying what subsea hardware. I am sure that someone will happily fill me in in due course.