I mentioned in a blog or two back that I recently attended a Natural Resources Forum event in London on the future of the UK offshore sector. A most interesting – maybe astounding is the more correct adjective – statement made there was that the UK will be one of the hottest exploration sectors in the world in 2019.

You could be forgiven for thinking that someone from Colorado had spiked your tea with some of their now legal magic mushrooms. I was quite taken aback myself, but this seemed to be a view not disputed by anyone else there. I now know why.

This morning I listened to a podcast – aren’t I just the 21st century guy now? – put out by the Oil & Gas Authority on just this subject. Having had two recent majors finds – this year’s Glengorm (CNOOC) in Central Graben and last year’s Glendronach (Total) in the West of Shetlands Northern Gas Hub area – the OGA and its invited guests all said that they expect there to be more. Equinor – it is still taking me a bit of time to get used to Statoil’s new name – has a four well programme this year and expects to have up to three wildcats per year going forward.

What was also of note was the disparate view on available capital. The OGA podcast had reps from Total, CNOOC and Equinor, all big or relatively big players, for its conversation and they all expressed concern about funding for future UK sector developments. But the speakers and the audience at the NSF event had different perspective. This group, made up of smaller and newer operators and often supported by venture capital, seemed to think that money was no object. If the development looked profitable, the cash could be found, a very notable difference in view.

***************************************************************************************

This was not the only difference of opinion expressed recently. With the oil price still yo-yoing up and down, some analysts and their followers are still feeling bearish about deepwater. Not Shell. Martin Stauble, veep for North America and Brazil, said Shell was happy to be moving forward in those two sectors without any doubts. It is not often that a management figure from an operator sticks his head above the parapet to offer a bullish view about anything except shale, Of course one has to remember that while Shell has been a leader in the deep waters of the Gulf of Mexico, it has been a follower in Brazil. Its positions there are the results of acquisitions, ie Enterprise Oil and BG Group, rather than early risk taking. Maybe, just maybe, they are coming out their ‘shell’, pun intended.

***************************************************************************************

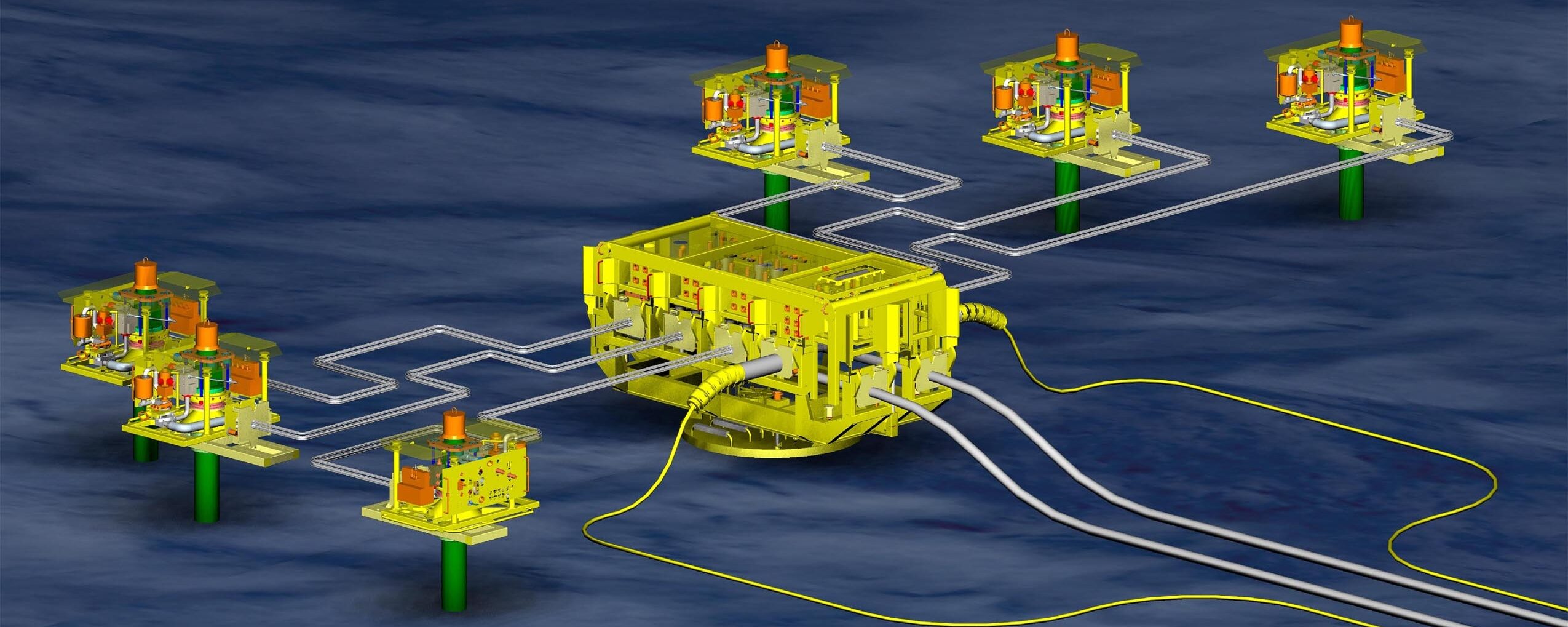

And now for something completely different…technology! I was very pleased to read about several new technology ventures being talked about at OTC – 3-D printing of components for oil and gas systems and wind-powered water injection – while also a bit more about the use of existing, but still not ‘catalogue’ technology, ie subsea boosting at Equinor’s Vigdis field.

But even newer are two new British ventures that are trying to spread ‘green’ paint all over the oil and gas industry. UK startup Legasea is proposing to offer a service to ‘repurpose’ subsea components following refurbishment. Over at the Oil & Gas Technology Centre, the latest additions to its TechX Pioneer low-carbon technology solutions initiative include Eltera which wants to convert waste heat energy from engines into electricity, while Optic Earth is using AI to improve seismic images for processing and interpretation. Every little bit helps.

One thought on “Did someone say exploration is hot in the UK?”

Watch the weather forecast instead , I remember the old saying “cut it 3 times and still too short …” too short of any new ideas ?