Offshore Europe 2019 starts next week and as per usual, there are talking points a many, some actually to do with business and others, maybe not.

TechnipFMC’s (TFMC) decision to split itself into two entities – a specialist upstream/subsea company and an onshore/midstream/downstream one – will have some scratching their heads. The decision to merge originally was based, at least partly, on the advantage of scale and the ability to withstand the vagaries of the oil business which can often see the upstream and downstream sectors on different cycles. This used to be the thinking behind integrated oil companies – when oil was cheap more money was made downstream and when oil was more dear, then vice versa.

As a long time observer, I would say that this move is being driven more by the dreaded ‘shareholder value’ philosophy than by more ordinary business strategy. Some analysts, in discussing this deal, have tried to compare TFMC to other oil sector supply/service companies, but really there are no satisfactory comparisons. To wit, TFMC is quite different, for example, from Schlumberger or BHGE because they mix their subsea hardware business with downhole and reservoir technologies, while Saipem has a significant drilling element in the company, but no subsea hardware and McDermott has fabrication and engineering to go with its installation capability, but no hardware nor downhole assets.

TFMC is the only one of the big subsea sector groups that can is truly integrated, ie can do everything from front-end work to installation work and life of field services. That is not to say that it is best at all of the elements – that is a discussion for another day – but that it can offer all of the elements which has certainly become more attractive over time. Avoiding external interface issues is certainly a benefit.

What all of the big subsea sector companies do have in common is significant investment in engineering personnel and if anything really drives these companies, it is the skill of their workforce and the ability to hold onto them in the face of rising – but read recovering – wage and benefit demands after the oil price crash of five years. (Aside: time really does fly – hard to believe that trauma was really that long ago now.)

We await with great interest what the two new companies will be called. Hopefully they will not waste any money on branding consultants who only come up with names that mean nothing

***************************************************************************************

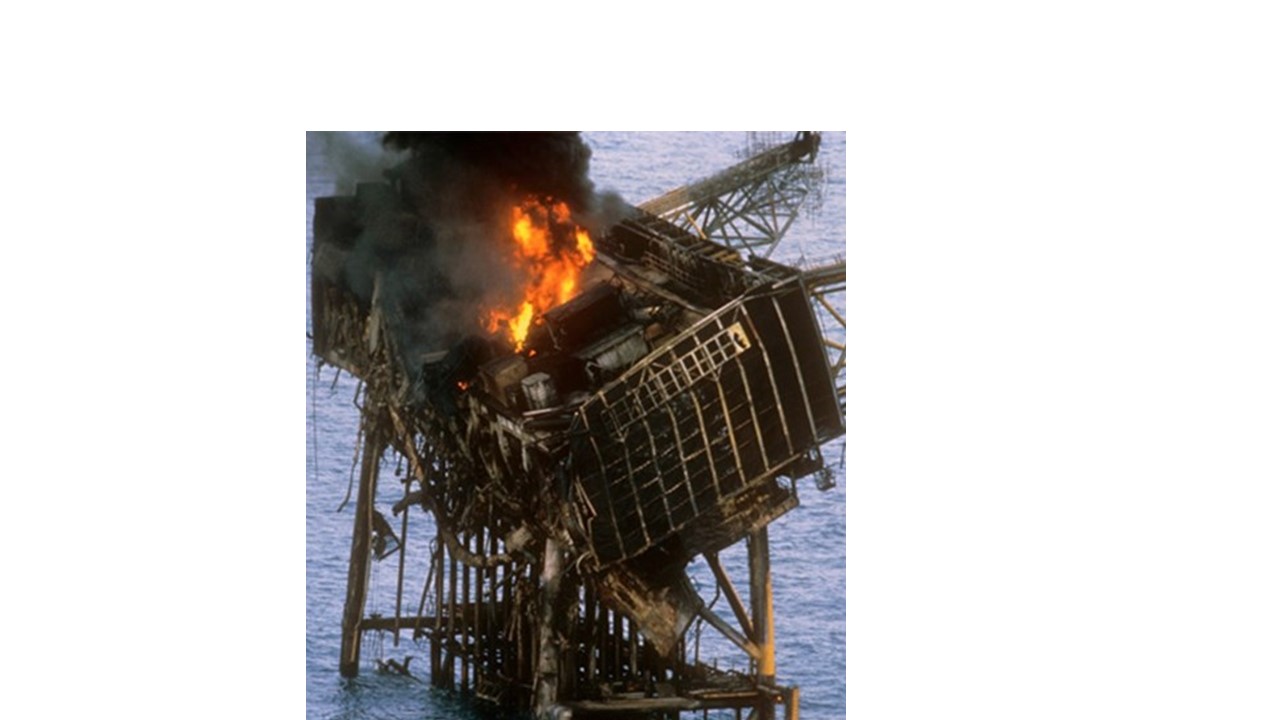

BP’s announcement this week that it was selling off its Alaskan assets to Hilcorp ends a long and not totally successful venture in the Arctic area. There were long running problems with its pipelines which, along with the Deepwater Horizon tragedy, made it an ongoing target for environmental activists. The biggest clanger, though, was the famous very expensive exploration well drilled back in the mid-1980’s – was it $100mn which was certainly a lot of money way back when – which targeted a very large structure identified by seismics, but turned out to be the most costly water well in history. If I recall correctly, BP dragged a bunch of journalists over to Alaska for this spectacular failure which may not have been a wise decision.

***************************************************************************************

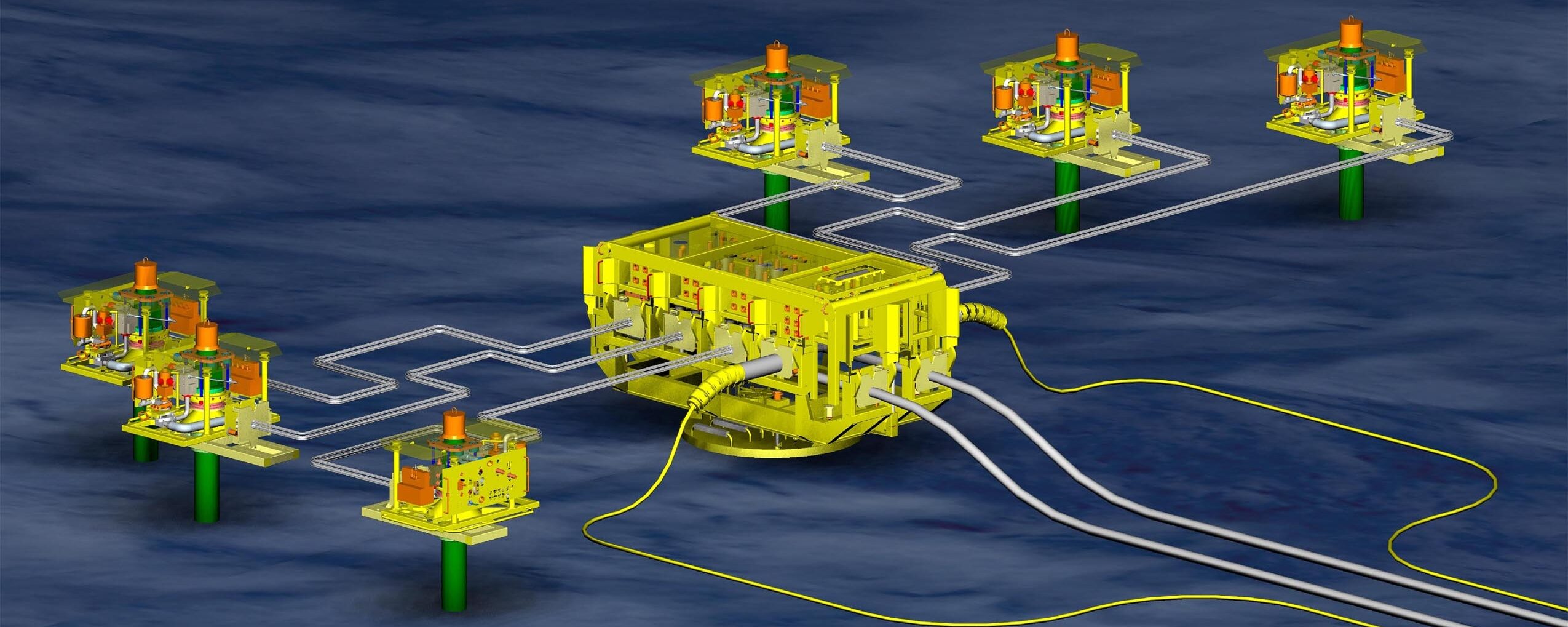

Another of the UK North Sea newbies, Siccar Point Energy, is pressing ahead with the development of the Cambo field in 1,100m of water, west of Shetlands. SPE picked up its stake in this prospect through its acquisition of OMV UK three years ago. What is most interesting is that it later sold a 30% stake to Shell. Hard to see Shell by sitting on its hands while this newcomer has to face up to the challenges inherent in what will be the deepest non-subsea development in the harshest environmental conditions in the UK sector. Shell does have some form as a ‘watcher’. It had to sit by and observe BP screw up the Foinaven development 25 years ago. Sembcorp Marine, now parent of Sevan SSP of circular fpso fame, and BHGE have picked up the front-end work here.

***************************************************************************************

And finally…the subsea services sector has sort of a ‘new’ player in the form of Boskalis Subsea. Although it has been around for a few years and parent Boskalis has been tinkering in the subsea market – in diving and vessels – for longer, it now wants to play with the big boys and is targeting the SURF market. It is doing what all newcomers do, it is telling the market that the big guys are only looking for big contracts and it only wants to help out operators with small jobs. And see how nimble we are. We can dance on the head of a pin. How magnanimous and clever. I am sure that Stuart Cameron who spent nearly 18 years with Subsea 7 is quietly chortling at this marketing strategy.

2 thoughts on “Is there life after Offshore Europe?”

Some good reflections there Steve!

In answer to your question, pleased to report that there does indeed still seem to be life of some form after OE.

Speaking as “the Shell guy who had to sit by as “watcher” and observe BP screw up the Foinaven development 25 years ago” I’d just like to add that the move into deepwater WoS threw up as many surprises in it’s own way as the leap into UMC complexity had done in just 150m a couple of decades earlier. An impressive and vital collaborative team spirit was thankfully sustained in addressing these problems in the Dyce offices, which was key to successfully overcoming them for the benefit of all future developments (just as had been the case with the UMC).

I made what is likely to have been my last pilgrimage to OE in the snazzy new “P&J Live”, “Event Complex”, “TECA”, or whatever else it seems to be called at Dyce, and mercifully it all turned well worthwhile by bumping into enough similarly tenacious old friends who were largely there for much the same purpose. I must admit though that there was a bit of a spooky feel about Aberdeen, which didn’t seem to have the buzz in the city that is normally associated with OE.

My boots are now firmly on the peg, and look like they are very comfortable staying there until they rot and crumble into eternity. Thanks to all oilfield friends and colleagues who have made the last 50 years (since joining Shell in 1968) such a tremendously enjoyable journey. Now for something completely different – whatever that may be

Steve, Ian,

Having joined Shell in Aberdeen in 1989 straight from working in the desert with Flopetrol / Schlumberger. I can only say that the six years or so I spent with Shell working on Osprey (Bob Bell, Oaksey, Pete Lowe, Derek MacKenzie, Mike Craib, Alex Bruce), Gannet (support role working for Oakesy & Nigel George), Brent South with Neil Dobson and before I left to join Halliburton, Pelican with Bob Bell is a time that has had the most influence on my career. I can remember Ian coming back into Tullos telling the subsea guys what was going on on Foinavon, certainly a challenge……… I believe that although the technology has changed and improved, basic principles still apply, failure to prepare and plan mean failure to deliver. During a recent trip to the USA I had conversations where I was told by a couple of vendors that they were looking to put in place interface management capability / technology / systems and “software” ……….ah well better late than never I suppose. Ian I hope your retirement is fun and Steve if your in Aberdeen – give ma a call the Turkish restaurant is still open.