In the dim and distant past, bidding on projects, or even on frame agreements, was a busy business. There were maybe up to six or more players in most categories – ie floaters, production equipment, risers, umbilicals, pipelaying, IRM, et al. All of the participants had to throw significant resources at these processes. I can recall once when bidders balked at the cost of the process and forced one of the big operators to actually pay them to submit a bid. Quite an achievement.

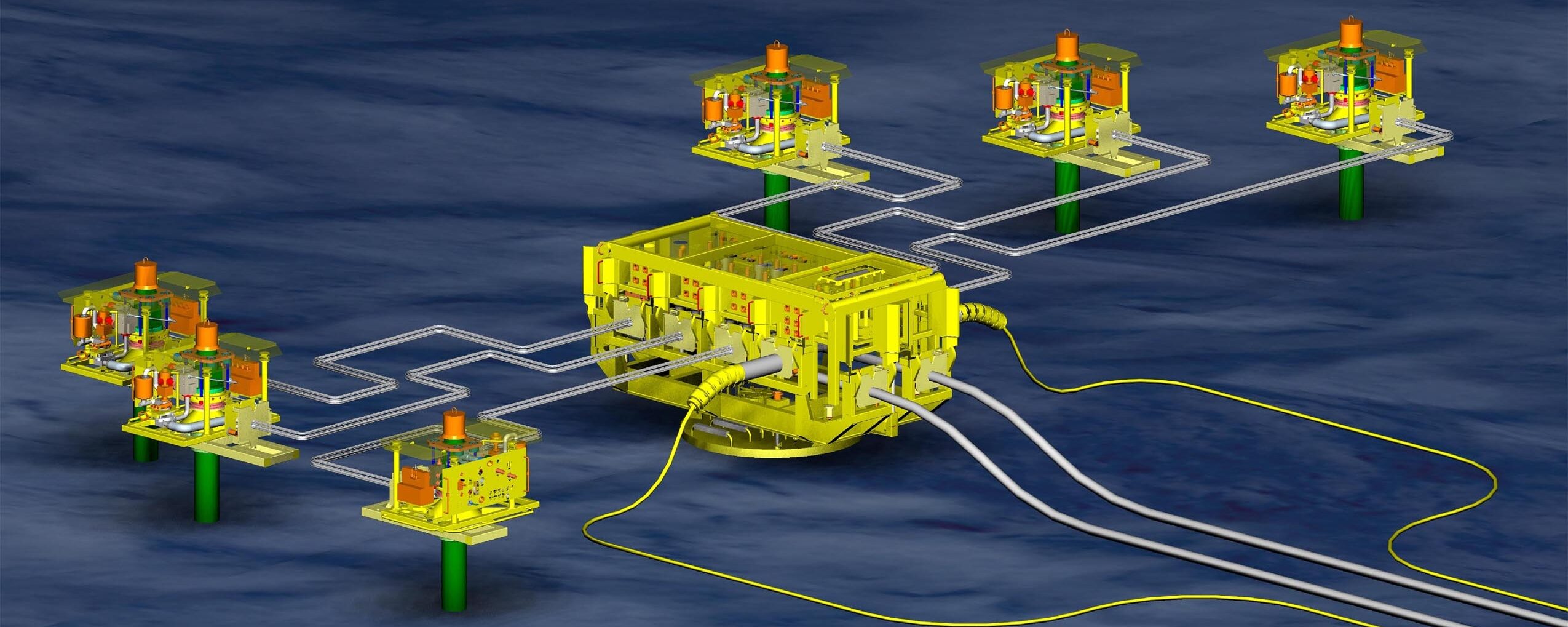

Much has changed and continues to change. Firstly, operators stopped bidding for all equipment separately and began bundling things together. So were born SPS and SURF packages. The former lumped together the big pieces of hardware (wellheads and subsea xmas trees plus sometimes seabed structures) with control systems and the ancillary connectors et al. The latter bunched infield flowlines, risers and umbilicals and occasionally export pipelines if there were any.

Some of these contractual conglomerations were driven by interface issues. At the time when even wellheads and xmas trees were bid separately, problems with interfacing different pieces of equipment became serious. There were even occasions when operators, in order to get the equipment they wanted in spite of prices, would specify specific interface requirements which would essentially eliminate some players even before the bid process began. The importance of interfaces became so high on operators’ agenda that they created new positions, ie interface managers, to oversee this activity to ensure that it did not disrupt project progress.

This has impacted competition which is why this piece was born, ie the announcement of the merger between Saipem and Subsea 7. This is hardly the first combination/merger to affect the marketplace. Companies have been merging, buying competitors and pulling in companies with associated equipment in order to create bigger packages and potentially higher margins for decades. So many players have disappeared or been absorbed into bigger entities that it is now hard to remember who they were. Do you recall Acergy, Vetco Gray, DUCO, Wellstream, GEC-Marconi Avionics, Cameron, et al? Some names still appear as product lines, but no longer as companies. Only fairly recently SLB, once Schlumberger, subsidiary OneSubsea joined forces with Aker Solutions which together had a venture with Subsea7. Nothing in the proposed merger announcement has been said about the future of this venture, although neither was anything suggested that would preclude it.

What this means is less competition, although each of the players had their own spheres of influence along with areas in which they competed. I am not suggesting for a moment that anyone should feel sorry for operators faced with one fewer installation contractor in the market. The long ago merger between Acergy and Subsea7 was essentially forced upon them when companies needed to be bigger in order to withstand the financial pressures being placed upon them by the operators. And so Saipem7 has been born.